BRICS Under Fire: August 1st Tariffs and Freight Rate Collapse Threaten Trade

- Wakool Transport

- Jul 8, 2025

- 10 min read

Updated: Jul 9, 2025

The Jul 10th Update

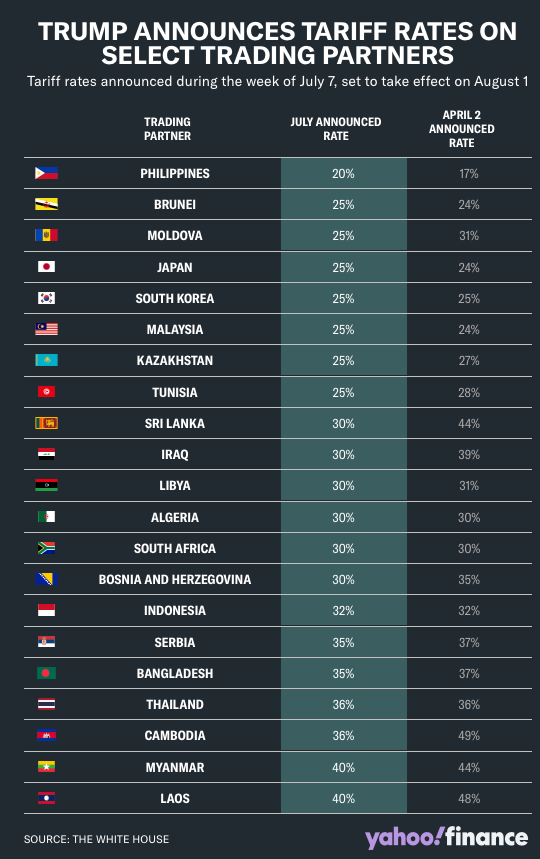

In a significant escalation of trade tensions, President Trump has dramatically expanded his tariff offensive by dispatching formal letters to 21 countries in two waves this week, cementing his August 1st deadline as immutable while introducing new sectoral tariffs that threaten to reshape global supply chains. The first batch of 14 letters sent on Monday targeted major trading partners including Japan and South Korea with 25% tariffs, while the second wave on Wednesday added seven more countries including the Philippines (20%), Sri Lanka (30%), and Iraq (30%). This represents the most comprehensive tariff escalation since Trump’s “Liberation Day” announcement in April, with rates ranging from 20% to 40% and no extensions promised.

The global response has been swift but varied, ranging from diplomatic protests to strategic pivots. Asian allies have taken a conciliatory but cautious approach: Japan’s Prime Minister Shigeru Ishiba called the tariffs “extremely regrettable” but confirmed continued negotiations, while South Korea announced plans to “accelerate negotiations”before the August 1st deadline. Thailand’s Deputy Prime Minister expressed confidence in securing “a competitive tariff similar to those on other countries,” and Malaysia’s government pledged to continue discussions with the U.S. Bangladesh has been particularly vocal, with Finance Adviser Salehuddin Ahmed expressing hope for favorable outcomes while the Bangladesh Garment Manufacturers and Exporters Association called the 35% tariff “absolutely shocking news” that could hurt our industry badly.

BRICS nations have mounted a more defiant response, with South Africa’s President Cyril Ramaphosa arguing that the 30% tariff was based on “inaccurate representation” of trade data and that 77% of U.S. goods enter South Africa duty-free. China has issued stern warnings against “restarting trade tensions” and threatened to retaliate against countries that make deals with the U.S. to exclude China from supply chains. Meanwhile, Vietnam’s successful negotiation of a 20% tariff rate (down from 46%) has created competitive pressure on other exporters, particularly in the garment sector where Bangladesh now faces a significant disadvantage.

The most striking development is the introduction of new sectoral tariffs: Trump announced a 50% tariff on copper imports, matching existing duties on steel and aluminum, and suggested tariffs as high as 200% on pharmaceuticals. These moves have created immediate market volatility, with COMEX copper futures falling over 3% after initially jumping on the announcement. The Trump administration has also confirmed that at least 10% additional tariffs will be imposed on any country “aligning themselves with the Anti-American policies of BRICS”, escalating the stakes for emerging economies. With Treasury Secretary Scott Bessent predicting tariff revenues could exceed $300 billion by year-end, Trump appears committed to using trade policy as both diplomatic leverage and fiscal strategy, despite widespread economic analysis suggesting the tariffs will worsen inflation and subtract from growth.

The Shift to an August 1 Implementation

The period leading up to August 1 has transformed from a waiting game into a high-stakes negotiation window. The Trump administration has clarified that this date marks the start of tariff enforcement, not merely a deadline, fundamentally altering global trade strategies. The initial 90-day grace period, originally set to expire on July 9, has been formally extended to August 1, 2025, creating a final three-week window for negotiations.

The administration's strategy has pivoted from broad threats to targeted action. This is highlighted by the formal notification letters sent on July 8, 2025, to 14 nations, which detail the specific "reciprocal tariff" rates that will take effect on August 1. This move replaces previous ambiguity with concrete figures and signals a transition into an active implementation phase.

These new tariffs are separate from any existing industry-specific duties. The letters also included a warning that any attempt to evade the tariffs through third-country transshipment would result in even higher penalties. Additionally, the U.S. has threatened to impose equivalent increases should any of the named countries enact retaliatory tariffs. For nations that do not finalize a deal by the August 1 deadline, tariffs are expected to revert to the higher levels first proposed on April 2.

From Broad Leverage to Targeted Action

The administration's strategy has shifted from general threats to precise implementation. This change is highlighted by several key developments:

A Tactical Delay: The three-week period until August 1 is being used to maximize deal-making leverage. Commerce Secretary Howard Lutnick confirmed that while tariffs take effect on August 1, "the President is setting the rates and the deals right now."

Specific Notifications: Formal letters detailing specific tariff rates (e.g., 25% for Japan and South Korea) were sent starting July 7. This move from broad warnings to targeted actions indicates a transition into an active implementation phase.

The "Boomerang" Threat: Treasury Secretary Scott Bessent has stated that countries without finalized deals by August 1 will see tariffs "boomeranging back" to April 2 levels, maintaining a high level of credible threat.

Market Response and Supply Chain Recalibration

The new clarity around the August 1 date has forced an immediate response from the market and a recalibration of corporate strategy.

End of Front-Loading: A 50% drop in transpacific shipping volumes indicates that the frantic front-loading of cargo to beat previous deadlines has largely ended. The August 1 date is now the primary factor dictating shipping decisions, superseding traditional seasonal demand.

Recalibrating Logistics: With a firm deadline, companies are actively adjusting their supply chains. As noted by Maersk, customers are "recalibrating their shipping plans" to navigate the complexities of the new timeline, balancing the opportunity to finalize shipments with the risk of facing new tariffs.

Global Trade Risk Assessment

The following table outlines the key risks in the current global trade environment and potential mitigation strategies for businesses.

Risk Vector | Near-Term Probability | Mitigation Strategy |

10% BRICS Surtax Implemented | High | Diversify manufacturing and sourcing to "non-aligned" nodes like Mexico and Turkey. |

Vietnam 40% Tariff Trigger Misapplied | Medium | Digitize country-of-origin data and pre-qualify value-add documentation to prove compliance. |

Transpacific Rates Fall Below COVID-Lows | Medium-High | Lock in favorable rates with forward contracts before carriers implement blank sailings to reduce capacity. |

Red Sea Conflict Escalates Beyond Yemen | Medium | Build in extended lead times for the Cape of Good Hope route into inventory and production planning. |

Kenya Probe Imposes Port Capacity Caps | Low-Medium | Pre-book inland haulage and logistics with multiple vendors to avoid dependence on a single provider. |

Trans-Pacific Freight Market Collapses in "No Peak Season" Scenario

Container freight rates on the trans-Pacific route have collapsed by 63% from their June peaks, signaling a fundamental shift in market dynamics driven by trade policy uncertainty rather than traditional seasonality. Rates from China to the U.S. West Coast have plummeted to $2,089 per forty-foot equivalent unit (FEU) from a high of $5,606, while U.S. East Coast rates have fallen to $4,124 per FEU.

Structural Shifts and Capacity Miscalculations

This dramatic decline is the result of a significant supply and demand imbalance. Anticipating high demand driven by tariff-related front-loading, ocean carriers increased shipping capacity by 46% in June. However, actual cargo volumes fell short as front-loaded shipments depleted future orders, leading to a severe capacity overcorrection.

The situation points to a structural, rather than cyclical, challenge for trade. BIMCO projects that North American import growth will be a mere 1.6% annually for 2025–2026, the weakest among major global trade regions. This has effectively created a "no peak season" scenario during what is historically the busiest time for shipping.

Volatility and Carrier Response

In response to the weakening demand, ocean carriers have already begun implementing blank sailings to withdraw excess capacity from the market. This strategy, however, introduces new volatility, as any unexpected rebound in demand could lead to fresh supply chain disruptions.

For supply chain managers, the immediate future remains uncertain. The market's direction will largely be determined by the implementation of the August 1 tariffs. Companies are advised to monitor shipping schedules closely, pre-book essential capacity, and develop contingency plans to navigate further rate volatility expected throughout the third quarter.

Trump Weaponizes Tariffs in New Ideological Trade War on BRICS-Aligned Nations

The U.S. administration has escalated its trade policy, moving from broad ideological threats to concrete punitive actions. On July 8, 2025, it issued formal notification letters to 14 countries, detailing new "reciprocal tariffs" that will take effect on August 1, 2025. This action replaces the previous general threat of a 10% tariff on BRICS-aligned nations with specific, higher rates, signaling a significant intensification of trade disputes.

Implementation and Immediate Impact

The new policy establishes a firm August 1 deadline, officially ending a 90-day negotiation period. The tariffs are presented as a response to unfair trade practices, but their scope and timing suggest broader geopolitical motivations. The targeted nations and their corresponding tariff rates are:

40%: Laos and Myanmar

36%: Cambodia and Thailand

35%: Bangladesh and Serbia

32%: Indonesia

30%: South Africa and Bosnia and Herzegovina

25%: Japan, South Korea, Malaysia, Kazakhstan, and Tunisia

The administration has warned that any attempt to circumvent these duties via third-country transshipment will lead to even higher penalties.

Strategic Consequences for Global Trade

This move fundamentally alters the global trade landscape by injecting severe political and economic risk into supply chain management. Multinational corporations with sourcing or manufacturing operations in the 14 targeted countries, which include major economies like Japan, South Korea, and Indonesia, now face immediate and substantial cost increases.

The inclusion of South Africa, a member of the BRICS bloc, underscores the policy's use as a tool to pressure nations over their geopolitical alignments. This aggressive stance is expected to disrupt established global trade flows, force costly and complex supply chain reconfigurations, and almost certainly trigger retaliatory tariffs and legal challenges at the World Trade Organization (WTO).

Red Sea Maritime Security Crisis Escalates, Disrupting Global Shipping

Security Breakdown and Escalation

On July 6, the Magic Seas bulk carrier, a Liberian-flagged and Greek-owned vessel, was attacked in the Red Sea by a coordinated assault involving eight small boats and four unmanned surface vehicles. This marks the first significant incident since the May truce announcements, highlighting the fragile nature of maritime security improvements in the region. The attack forced the crew to abandon ship, illustrating the increasing sophistication and intensity of threats.

In response, Israel launched unprecedented military strikes targeting three major Yemeni ports—Hodeidah, Ras Isa, and Salif—as well as the Ras Katib power station. This escalation from maritime attacks to strikes on critical port infrastructure signals a broadening conflict scope that could have lasting effects on regional shipping capacity.

Economic and Operational Implications

The Red Sea is designated a “High Risk Area” by international maritime insurers due to 14 attacks recorded in 2025 alone, ranging from drone strikes to hijacking attempts. As a result, major shipping companies such as Maersk, MSC, and CMA CGM continue to avoid the Red Sea route, opting instead for the longer Cape of Good Hope passage. This detour adds approximately 12,000 kilometers and over a week to Asia–Europe transit times.

The extended routing has led to permanent cost increases estimated at 25% for oil tankers and 18% for container ships. Given that about 12% of global trade typically transits the Red Sea, these disruptions introduce significant uncertainty and volatility to supply chains worldwide.

Broader Impact and Future Outlook

Insurance premiums have surged, and the need for enhanced naval patrols has increased security-related expenses. These elevated costs are expected to persist regardless of any potential resolution to the conflict. Shippers must urgently adjust routing strategies and inventory planning to mitigate the effects of prolonged transit times and rising operational costs.

The ongoing crisis underscores the vulnerability of a critical maritime corridor and signals potential long-term shifts in global shipping patterns and risk management practices.

This merged article combines the detailed attack description, military escalation, and economic analysis from Article 7 with the clear summary of operational impacts and industry responses from Article 8, providing a comprehensive and accessible report on the Red Sea maritime security crisis.

Kenya Launches Antitrust Investigation into Global Shipping Giants at Mombasa Port

Kenya’s Competition Authority (CAK) initiated a major antitrust investigation on July 2 against four of the world’s largest shipping lines—Maersk, MSC, CMA CGM, and PIL—over alleged anti-competitive practices at the Port of Mombasa. The probe, prompted by complaints from local logistics associations, targets claims of market abuse, price collusion, and discriminatory practices that have systematically marginalized Kenyan companies.

Scope of the Investigation and Market Impact

The investigation focuses on five key areas of alleged misconduct: exclusive dealing contracts, collusive pricing, abuse of vertical integration, unfair trading conditions, and the exclusion of local competitors through documentation arrangements. This regulatory scrutiny was triggered by the immense market power of these global carriers, which collectively control over 90% of the container cargo moving through Mombasa, East Africa’s primary trade gateway. The probe highlights a significant structural imbalance in the local logistics market. While Kenyan firms own 90% of the trucking assets, they secure only 30% of the related logistics contracts due to the vertical integration strategies of the international shipping lines. Further evidence of potential price discrimination includes the stark difference in demurrage fees, with charges in Kenya reported at $100 per day compared to just $20 per day in neighboring Tanzania.

Regional and Global Implications

With a deadline of September 30, 2025, the investigation’s findings could lead to significant penalties, including substantial fines or mandates for operational changes to foster a more competitive environment. Given Mombasa’s critical role in serving landlocked countries like Uganda, Rwanda, and South Sudan, the outcome will have far-reaching effects on regional trade. The Kenyan probe is also indicative of a broader global trend of increased antitrust scrutiny on the consolidated shipping industry, and its conclusions are likely to influence similar regulatory actions in other emerging markets facing comparable challenges.

Wakool Solution: Navigating the August 1 Tariff Landscape and Trans-Pacific Volatility

1. Dynamic Trans-Pacific Logistics Planning

Real-Time Market Monitoring: Wakool Transport closely tracks tariff policy developments and market rate movements, providing clients with timely updates and clear shipping guidance. With the August 1 tariff implementation set, we help shippers adapt plans, lock in rates, and avoid last-minute surprises.

Advance Capacity Booking: As carriers respond to rate collapses with sudden blank sailings, our direct relationships with ocean lines and real-time booking systems give clients access to stable, prioritized space—even as supply tightens unexpectedly.

2. Integrated U.S.–China Brokerage and Local Support

Full-Cycle Brokerage: With a robust team in Los Angeles and a local logistics office in China, Wakool coordinates every step from cargo origin to final U.S. delivery. We handle all scheduling, documentation, and compliance, including the evolving requirements tied to U.S.–China tariffs.

In-Market Presence: Our China-based team manages pre-export preparations, export customs, and local communications, ensuring smooth cargo handoff and minimizing the risk of bottlenecks during surge periods.

3. Risk Management Amid Policy Shifts

Tariff Compliance & Duty Optimization: We guide clients through the complexities of tariff classifications, documentation, and eligibility for Section 301 exclusions or other duty-saving programs, helping minimize unexpected costs.

Scenario Planning: With supply chain disruptions and shifting deadlines, we help importers and exporters build contingency plans—such as alternate routings or inventory staging—so business continues even as trade conditions change.

4. Port & Drayage Resilience

Port Congestion Solutions: Wakool’s LA-based team and owned trucking fleet enable rapid, flexible delivery from U.S. West Coast ports to inland destinations, reducing dwell times when ports are under pressure.

Equipment & Scheduling Support: We proactively manage chassis, container return, and port appointments, reducing client exposure to demurrage or missed sailings as conditions tighten.

5. Transparent Communication

No Overpromising, Just Results: Wakool delivers clear, realistic advice based on market data and operational expertise. We support each client with bilingual teams who provide status updates, shipment tracking, and regulatory alerts—without hype or inflated claims.

In a volatile environment shaped by August 1 tariff implementation and sharp market swings, Wakool Transportstands ready as your specialist for trans-Pacific logistics. Whether you need to navigate rate collapses, meet urgent shipping deadlines, or adapt to evolving regulatory changes, our cross-border team and integrated U.S.–China serviceensure you stay ahead.

Contact Wakool Transport to secure your space, optimize costs, and maintain supply chain resilience—whatever the next policy or market shock may bring.

Comments