Global Logistics Volatility Peaks: June 16–23, 2025 Market Corrections and Infrastructure Disruptions

- Wakool Transport

- Jun 22, 2025

- 9 min read

The final week of June 2025 has emerged as a defining period for global logistics networks, characterized by dramatic freight rate corrections, milestone infrastructure achievements, and strategic industry consolidations that collectively signal a fundamental realignment of international trade patterns. From the steep decline in Asia-U.S. container rates to historic achievements in Eurasian rail connectivity, the industry confronts both immediate operational challenges and transformative opportunities that will reshape supply chain strategies through the remainder of 2025.

Asia-U.S. Freight Market: The Great Rate Correction Unfolds

The Asia-U.S. shipping market experienced its most dramatic rate correction in over two years during the week of June 16–23, 2025, with spot rates plummeting as frontloading demand subsided and additional capacity returned to the market. Market guidance data from major Chinese ports reveals the extent of this adjustment, with express services (快提) dropping from early June peaks of $5,800 per FEU to $4,650 per FEU by mid-month—a striking 20% decline that reflects the volatile nature of tariff-driven cargo surges.

Rate Correction Timeline: • Early June: Express services at $5,800/FEU, Standard services at $5,300/FEU • Mid-June: Express services dropped to $4,650/FEU, Standard services to $3,950/FEU • Total decline: 20% for express, 25% for standard services

Rapid Market Dynamics and Carrier Response

The correction follows an extraordinary surge in early June, when the Shanghai Containerized Freight Index reported rates from China to the U.S. West Coast spiking 57% in a single week to $5,172 per FEU, driven by importers rushing to beat the August 14 expiration of temporary U.S.-China tariff reductions. However, by June 16, standard services (普提) had fallen to $3,950 per FEU, representing a 25% reduction from early June levels, while TEU rates stabilized at $3,000 per container. This rapid adjustment reflects carriers' aggressive capacity management strategies, with nearly 400,000 TEUs coming back online in the near term as suspended services were reinstated to capture windfall profits from the initial rate spike.

The market correction has been accompanied by significant operational pressures at Chinese ports, with waiting times at anchor in Shanghai-Ningbo rising to 29 vessels, while carriers report equipment shortages and frequent rollovers due to limited container availability. Industry analysts suggest that the correction may signal a return to more sustainable pricing levels as the initial panic-driven front-loading subsides and trade policy uncertainty begins to stabilize.

Implications for Trade Flow Patterns

The rate volatility underscores the continued sensitivity of trans-Pacific shipping markets to policy changes and seasonal demand patterns, with the 90-day tariff window creating artificial demand spikes that strain infrastructure capacity. Despite the correction, effective tariff rates on Chinese goods remain elevated at 55%, comprising baseline reciprocal tariffs, fentanyl-related duties, and Section 301 provisions that continue to influence sourcing decisions and inventory strategies.

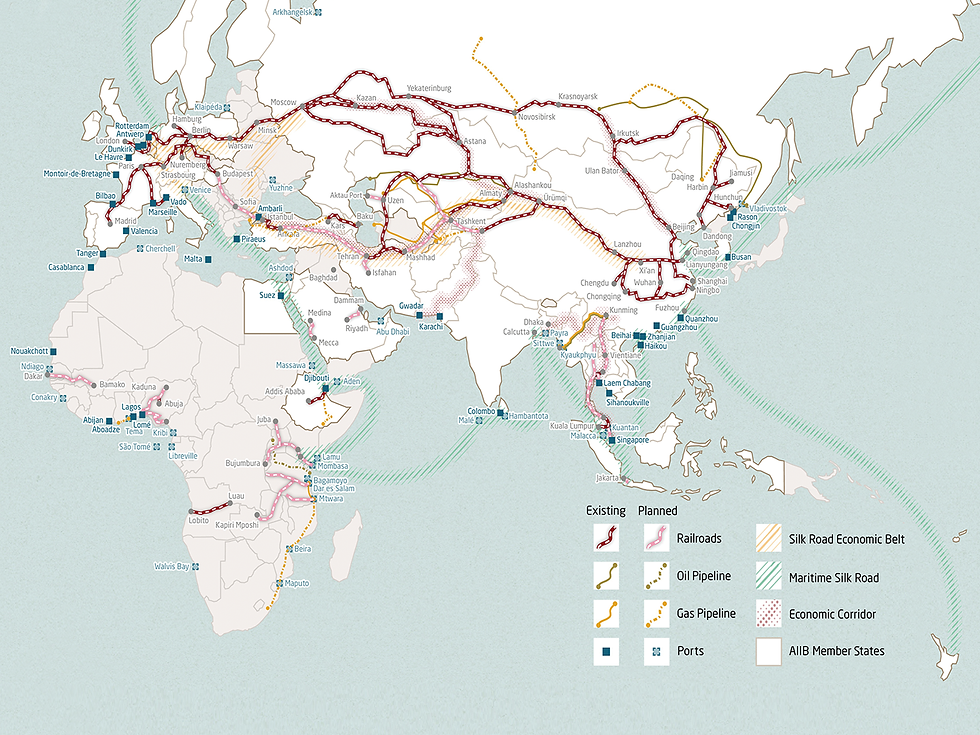

China-Europe Rail Milestone: 110,000th Train Marks Eurasian Integration

The China-Europe freight train network achieved a historic milestone on June 10, 2025, when the 110,000th train departed from Qingdao, carrying 55 containers of smart home appliances valued at nearly 20 million yuan bound for Moscow. This achievement represents more than a statistical landmark—it embodies the maturation of the Belt and Road Initiative's flagship logistics program, which has evolved from a modest experiment in 2011 to a cornerstone of Eurasian trade connectivity.

Network Expansion and Operational Excellence

The freight train service now connects 128 Chinese cities with 229 cities across 26 European countries and over 100 cities in 11 Asian nations, having transported goods valued at more than $450 billion since its inception. The network's operational sophistication has improved dramatically, with the time required to complete every 10,000 trains dropping from 90 months to just 6 months, reflecting both infrastructure enhancements and process optimization. Trains now depart every 30 minutes, offering transit times of approximately 17 days from China to Europe compared to 30-45 days by sea.

The 110,000th train's journey through Erenhot Port, the largest land port on the China-Mongolia border, highlights the critical role of border infrastructure in facilitating this growth. As the only port of entry and exit on the middle corridor of the China-Europe freight train service, Erenhot now operates 73 routes connecting China with over 70 hub stations in more than 10 countries and regions.

Strategic Implications for Global Supply Chains

The milestone underscores the growing importance of overland logistics routes in global supply chain diversification strategies, particularly as companies seek alternatives to maritime routes that have faced congestion and rate volatility. The rail network has emerged as a stabilizing force during supply chain disruptions, offering faster transit times than ocean freight while providing cost advantages over air transport. For logistics companies like Wakool Transport, this development represents both competitive pressure on traditional ocean-truck combinations and opportunities for intermodal partnerships that leverage rail's speed advantages for time-sensitive cargo.

MSC's Strategic Expansion: Mangalia Shipyard Acquisition Drive

Mediterranean Shipping Company's formal bid to acquire the bankrupt Damen Shipyards Mangalia facility in Romania represents a significant strategic expansion into European shipbuilding capabilities, marking MSC's evolution from pure shipping operator to vertically integrated maritime conglomerate. The Geneva-based shipping giant's interest, communicated through a letter from MSC Shipmanagement CEO Prabhat Kumar Jha on April 20, 2025, reflects growing fleet requirements and the need for geographically diverse shipbuilding capabilities.

Competitive Landscape and Strategic Intent

MSC faces competition from Turkey's Desan Shipyard, which has also initiated negotiations with Romanian authorities for production capacity rental arrangements. The Mangalia facility, majority-controlled by the Romanian state with Damen holding a 49% stake, has accumulated debts exceeding $425 million that surpass the value of its assets. Despite these financial challenges, the shipyard resumed operations in May 2025 with approximately 800 employees, demonstrating renewed viability.

MSC's strategic vision extends beyond fleet maintenance, with the company expressing intentions to consider the Mangalia shipyard for future construction projects in specialized segments, including cruise ships, ro-pax vessels, and tugboats. This diversification reflects MSC's growing presence in cruise operations and the need for European construction capabilities to complement existing Asian partnerships for container vessels.

Financial Recovery and Operational Revival

The shipyard's financial distress, with total creditor claims reaching RON 1.87 billion ($410 million), contrasts with assets valued at only RON 944 million ($190 million) at market prices. However, MSC's reported advance payments for ship repair services indicate sglobal-logistics-volatility-peaks-june-16–23-2025-market-corrections-and-infrastructure-disruptionerious commitment to the acquisition, while the facility's three drydocks and vast production capacity offer significant strategic value. The potential acquisition could shift some shipbuilding and repair activity from Asia to Europe, impacting regional capacity and competition dynamics.

Port Infrastructure Challenges: From Singapore to Global Congestion

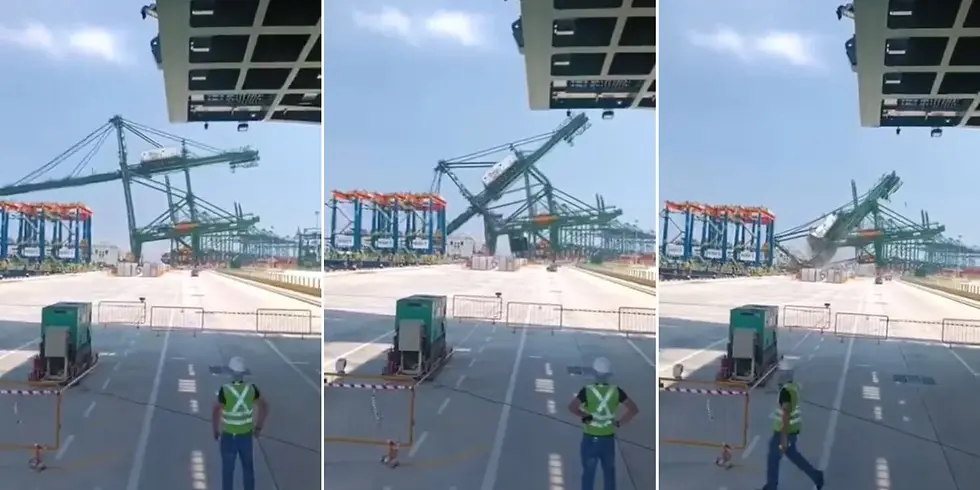

Tuas Port Crane Incident Highlights Infrastructure Risks

Singapore's Tuas Port experienced a significant equipment incident on June 15, 2025, when a new Sany quay crane tipped over during delivery to a non-operational berth, highlighting the operational risks inherent in complex port development projects. The incident, which occurred at approximately 1:20 PM without injuries or fatalities, involved a 65-tonne crane with a 35-metre span and 73-metre maximum forward reach that was part of the port's expansion toward becoming the world's largest fully automated container terminal.

While operational berths remained fully accessible and port development works continued unaffected, the incident serves as a reminder of the challenges associated with deploying advanced port equipment. Tuas Port, when fully completed in the 2040s, will occupy approximately 1,337 hectares and feature 66 berths with a handling capacity of 65 million TEUs.

Global Port Congestion Intensifies

Worldwide port delays have surged 300% in June 2025, with 96% of major container ports reporting operational disruptions. Critical hubs like Rotterdam, Cape Town, and Ningbo-Zhoushan are experiencing peak wait times exceeding 10 days, while demurrage fees range from $75 to $300 per container per day. Only 58.7% of ships globally are arriving on time, representing a sharp decline from pre-2020 averages of 80-90%.

U.S. ports continue facing severe operational challenges, with the Ports of Los Angeles and Long Beach experiencing vessel waiting times of up to 3 days, while four vessels remain anchored as carriers report increased congestion expected in July with the arrival of China's backlogged shipments. The Shanghai-Ningbo region shows 29 waiting vessels with slightly increased waiting times, reflecting the continued impact of frontloading activity and equipment constraints.

Trade Policy Evolution: Tariff Frameworks Stabilize at Elevated Levels

U.S.-China Trade Framework Confirmed

Following high-level meetings in London on June 9-10, 2025, the United States and China agreed to uphold the Geneva trade deal framework, with President Trump confirming that U.S. tariffs on China will remain at 55% while China's tariffs on U.S. goods stay at 10%. This composite rate structure includes the 10% baseline tariff imposed since April 2025, 20% fentanyl-related tariffs effective since March 2025, and 25% Section 301 tariffs on most Chinese goods implemented during Trump's first term.

Commerce Secretary Howard Lutnick confirmed that the 55% tariff rate on China will remain unchanged, providing some stability after months of policy uncertainty. However, due to overlapping duties, the effective tariff rate on most Chinese goods remains above 30%, significantly higher than pre-2018 levels and continuing to influence shipping patterns and supply chain planning decisions.

Steel and Aluminum Tariff Escalation

The Trump administration doubled Section 232 tariffs on steel and aluminum imports from 25% to 50% effective June 4, 2025, applying to all countries except the United Kingdom, which retains the 25% rate under the U.S.-UK Economic Prosperity Deal. These tariffs apply only to the steel and aluminum content of imported products, with non-metal components subject to other applicable duties. The escalation reflects continued concerns about domestic production capacity and national security considerations in critical materials sectors.

Section 301 Extensions and Compliance Updates

The U.S. Trade Representative announced a three-month extension of 164 product exclusions from Section 301 tariffs through August 31, 2025, along with 14 exclusions for solar manufacturing equipment. The Bureau of Industry and Security also added several household appliances to the tariff list of steel-derivative items, meaning they will be subject to an additional 50% tariff when imported into the U.S., with the new tariff coming into effect on June 23, 2025.

Supply Chain Disruptions and Technological Responses

Cybersecurity Threats to Food Supply Chains

A major cyberattack on United Natural Foods Inc. (UNFI), the primary distributor for Whole Foods Market, on June 5, 2025, forced the company to shut down its systems and suspend deliveries to over 30,000 grocery outlets throughout North America. Nearly two weeks post-attack, the company continues operating at limited capacity, relying on alternative methods and manual operations, highlighting the vulnerability of essential supply chains to cyber threats.

The incident resulted in significant product shortages at Whole Foods locations nationwide, with refrigerated and perishable sections in numerous stores stripped bare. The attack demonstrates how cybercriminals can disrupt software managing food distribution, creating supply chain crises that extend beyond traditional physical disruptions.

Industry Technology Adoption Accelerates

The volatility and disruptions of June 2025 have accelerated technology adoption across the logistics sector, with companies investing in AI-driven freight matching, route optimization, and predictive analytics to manage market uncertainty. Sage launched its Supply Chain Intelligence platform, promising to cut delays by 35% and provide real-time first-mile visibility for small and midsize businesses.

Strategic Outlook: Navigating Persistent Volatility

The convergence of rate corrections, infrastructure achievements, and policy stabilization in the week of June 16-23, 2025, underscores the need for adaptive supply chain strategies that can navigate an increasingly complex operational environment. The dramatic correction in trans-Pacific shipping rates demonstrates the continued sensitivity of freight markets to policy changes and seasonal demand patterns, while infrastructure milestones like the China-Europe rail achievement highlight the growing importance of modal diversification.

For logistics stakeholders, the current environment demands sophisticated risk management capabilities, real-time market intelligence, and flexible operational models that can adapt to rapid changes in trade policies, shipping rates, and infrastructure conditions. The ability to navigate these dynamics successfully will increasingly differentiate market leaders from followers in an era of persistent global supply chain complexity, with technology adoption and supply chain resilience becoming critical competitive advantages.

Wakool Transport: Navigating the June 2025 Market Reset

As trans-Pacific supply chains face historic volatility—from dramatic freight rate swings to shifting tariff regimes and persistent port congestion—Wakool Transport delivers practical, reliable solutions to help shippers maintain stability and cost control throughout every stage of the U.S.–China trade flow.

1. Smart Rate Management & Booking Flexibility

• Adapting to Market Changes: We closely monitor rate trends on U.S.–China routes, adjusting booking strategies to minimize costs and risks during price surges or drops.

• Securing Space in Tough Times: Leveraging strong carrier relationships, we prioritize space for your shipments, even during port congestion in China. Our real-time tracking allows us to reroute or reschedule to avoid delays.

2. Trade Policy & Tariff Support

• Navigating Tariffs: Our compliance team helps you adapt to evolving U.S.–China tariffs by advising on sourcing adjustments, product classifications, and customs documentation.

• Staying Informed: We provide regular updates on policy changes, Section 301 exclusion deadlines, and tariff impacts, ensuring you’re prepared for shifts in costs and trade flows.

3. Managing Port Congestion & Infrastructure Challenges

• Avoiding Delays: We track congestion at key U.S. and Chinese ports like Los Angeles and Shanghai, recommending alternative routes or early bookings to keep shipments on track.

• Handling Disruptions: When issues like port delays or equipment shortages arise, our teams in LA and China coordinate with carriers to recover or redirect cargo, minimizing costs and downtime.

4. Real-Time Visibility with Technology

• Track Every Step: Our tools provide live updates on your U.S.–China shipments, with alerts for issues and a user-friendly portal for managing data, invoices, and customs records.

In a market defined by unpredictability, Wakool Transport delivers calm, practical solutions for every U.S.–China shipping challenge—combining real-time intelligence, hands-on local support, and end-to-end reliability.

Comments