June 2025 in Crisis: Ports Under Pressure, Tariffs Roar Back, Retailers Reinvent Overnight

- Wakool Transport

- Jun 3, 2025

- 15 min read

Executive Summary

Evolving trade policies

Driven by the “America First” agenda, shifted towards protectionism. New duties and regulations affected allies and neighbouring countries. For example, imports from Mexico and Canada lost duty-free status if they didn’t comply with the U.S.-Mexico-Canada Agreement. A broad 10% tariff was considered but suspended due to industry opposition. The European Union and the United Kingdom strongly opposed these actions, warning of countermeasures and strained negotiations for a global steel agreement.

Supply Chain Diversification

Manufacturers and retailers are diversifying their supply chains to enhance resilience. Surveys show that about 75% of North American companies are reducing their reliance on China by an average of 40%. Production is being relocated to “China+1” destinations like Mexico, Vietnam, India, and other U.S. allies. Mexico, as the leading trading partner under the USMCA, has become a top nearshoring destination. This diversification lowers tariffs but introduces challenges like capacity shortages and rising costs in alternative markets.

Logistics and Transport Trends

After the disruptions caused by the pandemic, global logistics have stabilised but continue to face challenges. In the United States, the trucking industry has recovered from a freight recession and is expected to see a 1.6% increase in volumes in 2025, which will help maintain its dominance in the market. On the other hand, ocean shipping has transitioned from a crisis demand situation to a potential oversupply. New ships are being built that exceed the actual growth in trade, which could lead to a drop in container volumes by 1% in 2025 due to tariffs and the slowdown in trade between the United States and Asia. West Coast ports, such as Los Angeles, are experiencing a decline in cargo throughput as a result of the ongoing tariff dispute.

Retail and Industry Adaptations

Leading retailers like Walmart and Amazon have revamped strategies to cope with rising costs and uncertainty. Walmart, still sourcing 20% of products from China, expanded its supplier network to over 70 countries and increased reliance on Mexico for tariff-free imports. To mitigate tariff-related price hikes, Walmart negotiated supplier pricing and stockpiled inventory. Amazon invested in logistics, adding regional fulfilment centres and leveraging AI for inventory placement, improving efficiency by 25% over the past year.

June 2025 – Tariff War 2.0 and a Temporary Truce

In May 2025, an emergency negotiation in Geneva led to a temporary truce. Both sides scaled back the latest tariff additions to a manageable level. The U.S. reduced its new tariffs to +10%, bringing the average tariff on Chinese imports down from 126.5% to about 51.1%. China lowered its retaliatory duties to about 32.6%. These rates still covered all trade but at much less crippling levels. Essentially, the U.S. and China dialled back tariffs to early 2025 levels (roughly doubling the pre-war levels), described as a “pause” in the tariff war. The U.S. removed extreme hikes and settled on about 30% additional tariffs for 90 days.

This truce doesn’t resolve the trade war; it’s a temporary de-escalation. Technology, subsidies, and market access disputes remain. As of June 2025, diplomats restart trade talks, but tariffs are still high. Businesses assume elevated tariffs are the “new normal” with occasional flare-ups or partial relief. The U.S. administration uses tariffs broadly, even on allies, as leverage. In April 2025, it announced a “national security tariff” of 10% on all imports, but postponed it due to legal challenges and pushback. Such an across-the-board tariff shocked supply chain planners. Companies hedge against trade policy volatility by diversifying sourcing and using duty mitigation strategies like bonded warehouses, tariff engineering, and free trade agreements.

The aggressive U.S. stance is straining relations with trading partners and complicating existing agreements. The U.S.-EU negotiations for a Global Arrangement on Sustainable Steel and Aluminium (GASSA) have stalled. The EU had suspended retaliatory tariffs pending a deal, but after the steel tariff double-cross, EU officials warned they are “prepared to impose countermeasures.” The USMCA partners (Canada, Mexico) have thus far avoided direct blanket tariffs, but the U.S. did tighten enforcement by targeting goods not meeting rules of origin. There were also hints of tariffs tied to immigration issues, such as a 25% tariff on Mexican goods to pressure Mexico on border security. However, as of mid-2025, such a tariff has not materialised, likely due to the economic self-harm it would cause. Nevertheless, the climate is one of increased scrutiny, with even friendly nations not entirely exempt from Washington’s protectionist tilt.

In Asia, U.S. allies like Japan and South Korea are closely watching. The U.S. has sought to coordinate with allies on curbing China, for instance, aligning export controls on advanced semiconductors. However, the broad use of tariffs has raised concerns about U.S. unilateralism. The absence of new trade liberalisation initiatives (the U.S. has not pursued major new free trade agreements, instead focusing on partial frameworks like the Indo-Pacific Economic Framework) means that for now, the trade agenda is dominated by enforcement and defensive measures. Businesses engaged in international trade have been advised to stay nimble: leverage tariff exemptions or exclusions if available, revisit sourcing and pricing strategies, and keep an eye on policy announcements that could suddenly change cost structures.

Steel and Aluminum Trade Policy: From Section 232 to Showdown

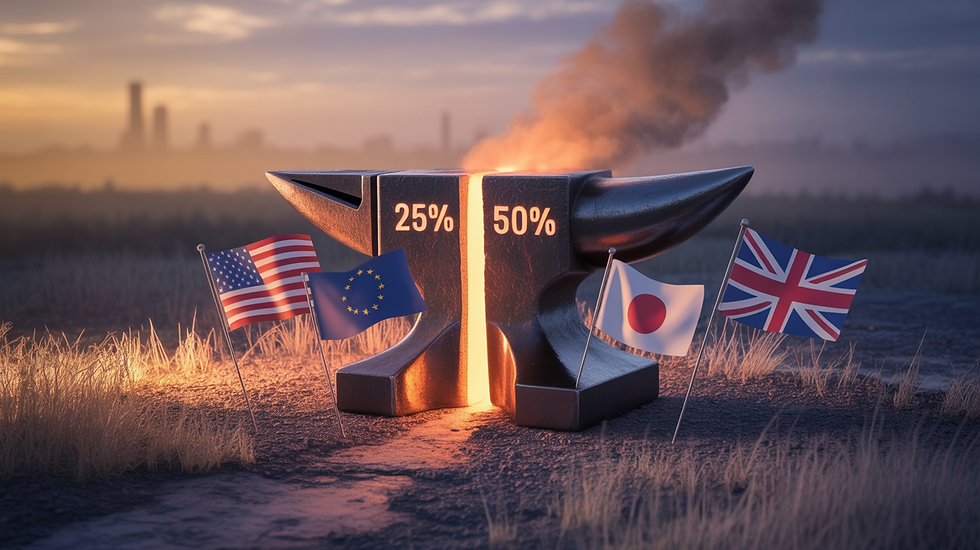

The U.S. doubled its metal tariffs to 50%, drawing criticism from the EU. The U.S. and EU agreed to extend the tariff ceasefire through 2025, linking market access to producing “green” low-carbon steel and addressing Chinese overcapacity.

2025 Shock - U.S. Doubles of Metal Tariffs to 50%

In March 2025, the U.S. stunned global markets by suddenly announcing a doubling of Section 232 tariffs on steel and aluminum imports—from 25% to 50%. President Trump’s move aimed to strengthen U.S. metal producers and safeguard “national supply,” responding to long-standing pressure from domestic steelmakers who argued that even existing tariffs hadn’t stopped foreign metals (often Chinese, or routed via third countries) from undercutting prices.

The new 50% tariff applies globally, except for nations with special deals, immediately pressuring the EU and other trading partners to negotiate exemptions. The abrupt escalation threatens to disrupt the previous trade balance and intensifies uncertainty across manufacturing and supply chains.

Global Reaction to U.S. Steel Tariffs

The European Union condemned the U.S. doubling Section 232 steel tariffs to 50%. EU officials said it raises costs, undermines negotiations, and may lead to retaliation. European steelmakers fear losing access to the U.S. market.

The UK’s tariff deal is in doubt, as officials seek clarity on whether the new tariff will override their agreement. Major allies like Japan, South Korea, and Canada are also concerned. Canada and Mexico are exempt, but the U.S. hinted at reimposing tariffs, causing anxiety in Canada’s steel sector.

After the Geneva truce in May 2025, the U.S. delayed the 50% tariff rollout to negotiate with allies. The EU extended its freeze but expects progress on a new steel trade agreement. Talks on a “Global Sustainable Steel Arrangement” are critical: a deal could limit tariffs to high-carbon or excess steel, but failure could trigger a tariff war.

Tariff battles disrupt supply chains and raise costs for manufacturers like construction, automotive, machinery, and food canning. U.S. firms have endured 25% tariffs; a 50% jump would push prices higher and risk inflation. Some seek exclusions or domestic suppliers, while European steelmakers may redirect exports or seek government support.

The dispute highlights trade friction among allies and the urgency for negotiations linking trade policy to broader issues like climate goals in the steel industry.

Supply Chain Reactions: Diversification, Resilience, and “China+1”

Strategy | Actions | Outcomes |

Diversification away from China | 72% of North American supply chain leaders prioritise reducing reliance on China | Production migration to Mexico (proximity, USMCA) and Southeast Asia (Vietnam, India, Thailand) |

Shift in production focus | Vietnam: Electronics, footwear, furniture; India: Smartphones, chips, components | Potential capacity constraints, higher costs in Mexico and Vietnam; India and Indonesia lack mature supplier ecosystems and logistics infrastructure |

Inventory strategy adjustment | Shift from pure ‘just-in-time’ to ‘just-right’ mix | Walmart’s FOB terms strategy: Direct tariff management, stockpiling essentials |

Onshore investment boost | Accelerated by U.S. policies (CHIPS Act, Inflation Reduction Act, Buy-American rules) | Emergence of multi-node manufacturing web (Americas, Europe, Asia) |

Logistics adaptation | Increased cross-border trucking from Mexico, greater reliance on East Coast and Gulf ports, wider use of bonded warehouses and FTZs | More regional, redundant, and tech-enabled supply chains by mid-2025 |

Tariffs, pandemic shocks, and intensifying U.S.–China tensions have forced companies to rethink the old “single-sourcing, just-in-time” playbook. A survey of 200+ North-American supply-chain leaders shows 72 % now prioritize cutting reliance on China; more than half will trim China sourcing by at least 10 % in the next year, targeting ≈40 % reduction mid-term. Most of that production is migrating to Mexico—favoured for proximity, USMCA duty-free access, and a mature auto-electronics base—and to Southeast Asian hubs such as Vietnam, India, and Thailand. Vietnam has captured electronics, footwear and furniture; India is attracting smartphones, chips, and components.

Diversification, however, brings its own friction. Capacity in Mexico and Vietnam is tightening, pushing up land and labour costs; India and Indonesia still lack deep supplier ecosystems and logistics infrastructure. China’s wage gap has narrowed, yet rebuilding alternate supplier bases means higher short-term costs that firms accept as the price of resilience.

At the same time, nearshoring and regional hubs are booming. Auto and battery makers are building a North-American EV chain spanning U.S. and Mexican plants, while retailers like Walmart have ploughed US $2 billion into Mexican and Central-American sourcing to shorten lead times and dodge tariffs. Inventory strategy has shifted from pure JIT to a “just-right” mix: fast movers remain lean, but critical SKUs carry buffer stock. Walmart’s switch to FOB terms—making it the importer of record—let it manage tariffs directly and stockpile essentials ahead of potential hikes.

Washington’s CHIPS Act, Inflation Reduction Act, and Buy-American rules accelerate on-shore investment: new semiconductor fabs, low-carbon steel mills, an aluminium smelter, and automated plants for medical supplies. The result is an emerging web of multi-node manufacturing—Americas, Europe, and Asia nodes—rather than a single China hub. Full decoupling is unlikely: China still supplies many inputs and channels capital into Southeast Asia, but final assembly is spreading out.

Logistics networks are adapting in parallel: more cross-border trucking from Mexico, greater reliance on East-Coast and Gulf ports, and wider use of bonded warehouses and FTZs to defer or avoid tariffs. By mid-2025, supply chains are visibly more regional, redundant, and tech-enabled, positioning firms to absorb the next tariff hike, labour strike, or black-swan disruption with far less upheaval than before.

2025 U.S. Trucking Snapshot – Logistics and Transportation Industry Trends

The ripple effects of trade policy and supply chain shifts are strongly felt in the logistics and transportation sector. After the tumultuous peak of 2021–2022 (with port congestion, container shortages, and sky-high freight rates), the logistics world entered a corrective phase in 2023. By 2024 and into 2025, conditions have normalized in some areas but deteriorated in others, yielding a mixed landscape

After a two-year freight slump, truck volumes are set to grow about 1.6 % in 2025, according to the American Trucking Associations. Contract bids for the year already show firmer demand, and shippers report modest volume gains as inventories realign with consumer spending.

Trucking remains the backbone of U.S. freight, hauling roughly 73 % of domestic tonnage and heading toward 76 % of freight revenue by 2035. E-commerce growth keeps parcel and LTL lanes busy, while highway-upgrade projects funded by the 2021 infrastructure law are easing chronic bottlenecks and boosting productivity on key corridors such as Chicago’s Byrne Interchange.

Key 2025 pressure points:

Capacity and Labour: The driver shortage is expected to intensify as volumes increase. Wage competition for long-haul drivers is already accelerating.

Regulation: The ongoing implementation of California’s AB5 employment rules and nationwide enforcement of ELD regulations will reduce effective capacity but also encourage investment in efficiency technologies.

Costs: Diesel prices have risen slightly from their 2024 lows, reaching approximately US$3.70 per gallon in February 2025. Any significant increase in fuel prices could squeeze margins and trigger contract surcharges.

Technology: Route-optimisation software, telematics, and early autonomous truck pilots are gaining traction, promising incremental capacity gains and reduced empty miles.

In essence, 2025 marks the commencement of a substantial recovery following the 2023-24 “freight recession.” The sector is poised for sustained growth, albeit at a cost-conscious pace, driven by increased volumes, enhanced infrastructure, and technological advancements. Nevertheless, capacity limitations and labour costs will dictate the trajectory of rate negotiations throughout the decade.

Ocean shipping and port developments – Mid-2025 Snapshot

Category | Trend | Impact |

Demand vs. Capacity | Flood of mega-ships hitting the water as trade softens | Clear oversupply in the market |

Freight Rates | Spot prices settled into a low, volatile band | Lower shipping costs, but still above pre-COVID averages |

Carrier Response | Cancelling 15-20% of Asia-U.S. sailings per month | Price support through blank-sailing programs |

U.S. Port Volumes | Tariff-driven order cuts leading to double-digit import declines at West Coast hubs | Lower container throughput at U.S. ports |

Regulatory Wild Card | “China ship fee” imposed from late 2025 on vessels operated by Chinese carriers or built in China | Potential increase in costs for importers from China |

Port & Network Upgrades | Congestion largely gone due to dockworker contract and berth/rail expansions | Improved operational efficiency and reduced dwell times |

Alliance Shake-ups | Break-up of the 2M Alliance (Maersk-MSC) leading to schedule and slot-sharing changes | Increased service variability and potential transit time impacts |

Intermodal Outlook | Rail reliability gains and tighter trucking capacity expected to lift volumes by 3% in 2024 | Moderate rate pressure returning by Q4 2025 |

Sustainability Push | New IMO carbon-intensity rules and regional sulphur caps leading to slow-steaming and LNG-ready tonnage deployment | Increased bunker-cost volatility passed on through fuel surcharges |

Ocean shipping in 2025 is defined by vessel oversupply colliding with flat demand. Mega-ships ordered during the pandemic are arriving just as Fitch and Drewry project a ≈1 % contraction in global container throughput, pushing spot rates down to roughly US $2,500/FEU—a fraction of 2021 peaks. To stem further erosion, carriers have blanked 15–20 % of Asia-US sailings and shifted surplus tonnage to other lanes, yet rate pressure is expected to persist all year.

U.S.–China friction remains the biggest trade shock. Higher tariffs and cooler relations have trimmed Trans-Pacific volumes, leaving West-Coast yards visibly quieter and slowing the earlier cargo shift to Gulf and East-Coast ports. Washington is doubling down: from late-2025, large vessels operated by Chinese lines or built in Chinese yards must pay a new “China ship fee,” signalling that port access is now a policy lever. Only about 7 % of 2024 calls would have paid, but the move underscores a gradual logistics decoupling.

Operationally, pandemic-era congestion has cleared. A six-year ILWU labour deal (mid-2023) and berth-rail upgrades at Los Angeles, Savannah and the Panama Canal have normalised dwell times, though European hubs face intermittent backlogs. Alliance upheaval—the 2M split—continues to reshuffle schedules, while inland networks gain ground: improved rail reliability should lift North-American intermodal volumes ≈3 % this year, and bonded or FTZ routings are increasingly used to blunt tariff costs.

Sustainability rules add a final constraint. IMO carbon-intensity targets and U.S. zero-emission goals are nudging carriers toward LNG-ready tonnage, slower steaming and higher bunker surcharges. Taken together, 2025’s landscape rewards shippers who balance multiple carrier partners, diversify port choices and keep routing options flexible enough to absorb the next geopolitical or fuel-price shock.

2025 Retail Reinvention: Walmart, Amazon & Peers Rewire Supply Chains with AI, Diversification, and Just-in-Case Agility

Walmart, a major importer, diversified its supplier base, leveraged its scale to negotiate cost-sharing on tariffs, and adopted a “Just-in-Case” inventory strategy to mitigate the impact of tariffs. Amazon, while not primarily affected by tariffs, focused on improving fulfillment efficiency and delivery speed by chartering ships and adopting a regional fulfillment model. Both companies demonstrated adaptability in response to global trade and logistics disruptions.

Amazon overhauled its inbound logistics, opening new facilities and leveraging AI/ML for demand forecasting and routing. This allowed for greater control over inbound flows and improved supply chain speed. Beyond Amazon, other retailers diversified sourcing, invested in automation, and enhanced supply chain visibility to mitigate risks and improve resilience.

Walmart’s 2025 Supply-Chain Playbook: Diversified Sourcing & AI-Smart Inventory for Tariff Resilience

Walmart entered 2025 with most of its tariff-defence measures already in place. About two-thirds of the goods it now sells in the U.S. come from domestic or duty-free sources, the result of a five-year drive to dilute China exposure. The retailer’s network of 70-plus origin countries—anchored by Mexico for tariff-free electronics and appliances—lets buyers switch suppliers within a single planning cycle when duties shift. Inventory policy is no longer a blunt stock-up; AI forecasting tools flag SKUs that must carry “just-in-case” buffer while keeping fast movers lean. Combined with end-to-end visibility and FOB pricing that shows the exact tariff hit, the system lets Walmart raise prices surgically instead of across the board—and protects its Everyday Low Price reputation.

Strategy | Description | Impact |

Supplier Diversification | Aggressively diversified supplier base to over 70 countries by 2025. | Reduced overreliance on China and provided flexibility to adjust orders in response to new tariffs. |

Pricing and Cost Mitigation | Shifted contracts to FOB terms, negotiated cost-sharing with suppliers, and selectively adjusted retail prices. | Increased transparency on tariff costs, allowed Walmart to absorb some costs while passing on others to consumers, and maintained competitive pricing. |

Inventory Strategy | Adopted a ‘Just-in-Case’ strategy, proactively bringing in shipments before tariff effective dates. | Delayed the immediate effect of tariffs on consumers, but led to inventory excesses in 2022 when demand shifted. |

Technology Integration | Leveraged AI-powered logistics tools for route optimisation, inventory forecasting, and energy efficiency. | Improved supply chain efficiency, enabled faster order adjustments, and provided real-time visibility. |

Amazon’s 2025 Fulfillment Overhaul: Regional Zones, AI-Driven Routing & Diversified Sourcing for Turbocharged Delivery

Amazon spent 2023-24 re-wiring its fulfilment web and is now reaping the gains. The U.S. is carved into regional zones, each holding top sellers close to customers; a 25 % improvement in inventory placement has trimmed cross-country hauls and shaved delivery times. New cross-dock and sort centres, Amazon Freight trucking, and AI-directed container splitting at ports give the e-commerce giant tighter inbound control. The transition briefly pinched third-party sellers in 2024, but extra capacity and fee tweaks smoothed the bottleneck. Diversification mirrors the marketplace: private-label production has expanded in Vietnam and India, and many sellers now import from a wider set of origins, limiting tariff shock.

Area | Action | Impact |

Fulfilment Network | Shifted to regional model with inventory strategically placed across the U.S. | 25% increase in inventory spread across fulfilment centres, faster delivery times, reduced long-haul costs |

Inbound Logistics | Opened 15+ cross-docking and sorting facilities, encouraged suppliers to use Amazon Freight | Improved routing efficiency, greater control over inbound flows |

Technology | Utilised AI/ML for demand forecasting and routing algorithms | More accurate inventory placement, optimised delivery routes |

Third-Party Seller Challenges | Warehouse revamp led to temporary capacity constraints and delays for FBA sellers | Amazon rerouted shipments and reduced storage fees to mitigate impact |

Trade Diversification | Marketplace sellers and AmazonBasics sourced from countries like Vietnam and India | Mitigated risks from China-U.S. trade tensions, potentially lower costs |

Retail Sector 2025 Resilience Playbook: Backup Capacity, Omni-Channel Automation & Multi-Partner Networks

Sector-wide signals echo these moves. Big-box chains still charter backup capacity when ports wobble; apparel brands pair Vietnam or Bangladesh sewing lines with rapid-replenishment hubs in Mexico or Central America; automakers localise battery and chip supply under U.S. incentives and mineral tariffs. Warehousing demand has cooled from the 2022 frenzy yet continues to shift toward automated, omni-channel nodes that can ship to store, doorstep, or parcel locker with equal ease. Across the board, risk management now outranks pure cost: retailers keep scenario models for new tariffs or port shutdowns, cultivate multiple logistics partners, and accept slightly higher landed cost as the price of staying in stock and on-time in 2025’s uncertain trade climate.

Industry | Response | Challenges & Opportunities |

Apparel/Retail | Diversification out of China (Vietnam, Bangladesh, Central America) | Rising labour costs, longer lead times, supply chain visibility |

Big-Box & Grocery | Port diversification, local sourcing | Resilience, steady supply |

Automotive | Shortening chip supply chains, inventory buffers, North American battery plants | Microchip shortage, EV push, tariffs on batteries and minerals |

Omni-Channel & Warehousing | Omnichannel fulfilment, inventory rerouting closer to customers | Robust inventory data, last-mile planning |

Warehousing | Automation investments | Market cooling, subleasing, overcommitted space |

Conclusion

Looking ahead, the logistics and supply chain landscape remains dynamic and unpredictable. U.S.–China trade policy is still a major source of uncertainty; the current tariff truce is only temporary and could be reversed, so executives must closely monitor any updates from trade talks. Possible renewed negotiations between Washington and Beijing could bring further changes, but outcomes are unclear. Likewise, the ongoing steel tariff dispute with Europe requires resolution to avoid escalating transatlantic tensions.

On the positive side, companies have made significant strides in building more resilient supply chains—diversifying suppliers, increasing safety stocks, and improving end-to-end visibility. These efforts mean businesses are now better equipped to handle shocks, whether from health crises, natural disasters, or geopolitical conflicts. The concept of a “resilient, diverse, and secure” supply chain is becoming a reality.

In the logistics sector, growth is expected to resume in tandem with economic recovery. Technology advances—like AI-powered demand forecasting, autonomous trucks, and warehouse robotics—are expected to drive greater efficiency and help offset cost pressures.

Sustainability will also shape the future of logistics: by 2030, supply chains will face increased demands to decarbonize, requiring changes such as shifting to intermodal rail, adopting electric vehicles, and sourcing locally to reduce emissions.

Wakool Solution: Building Resilience in a Volatile Trade Era

Facing unprecedented tariff shifts, policy uncertainty, and evolving supply chains, Wakool Transport delivers flexible, end-to-end logistics solutions tailored for today’s challenges:

1. Dynamic Logistics and Fulfilment

Port and Routing Flexibility:

With West Coast volumes under pressure and new “China ship” fees looming, we offer alternative routes through East and Gulf Coast ports.

Consolidated air-sea options ensure your goods remain in transit even during regional disruptions.

Integrated Warehousing and Faster Turnaround:

Our China branch coordinates inbound shipments to U.S. warehouses, allowing you to pre-position inventory in advance of tariff changes.

In-country warehousing in both China and the U.S. supports “just-in-case” buffers—stockpile when necessary and release promptly when demand increases.

2. Strategic Diversification and Tariff Mitigation

Balanced China-Plus Network

Wakool leverages our in-country expertise to manage cost-effective China-U.S. flows while simultaneously expanding into Mexico, Vietnam, India, and other “China + 1” markets.

This approach ensures the preservation of established China routes when necessary, while also providing alternative sourcing hubs to mitigate the impact of sudden tariff hikes.

Tariff Engineering and Duty Management

We utilise bonded warehouses and free-trade zones to help you defer or reduce import duties, thereby optimising landed costs as U.S. “national security” tariffs or Section 232 metal duties fluctuate.

Our team provides expert advice on rules-of-origin, preferential agreements, and duty drawback opportunities to help you keep your overall tariff bill in check.

3. Real-Time Shipment Tracking

Transparent Visibility

Monitor every stage of your cargo’s journey—from the factory floor in China to the final mile in North America—using our real-time tracking platform.

Receive timely notifications about delays or customs holds, allowing you to make adjustments to your orders and avoid costly stockouts or over-inventory.

4. Compliance and Regulatory Guidance

Trade Policy Intelligence

Our experts monitor U.S.-China, U.S.-EU, and USMCA developments daily, providing timely alerts on tariff truce windows, imminent rate hikes, or steel/aluminium freeze extensions.

We analyse how changes, such as a 50% steel tariff or a postponed 10% “national security” duty, impact your landed costs.

Customs & Documentation Support

Wakool handles HS-code verification and origin-certification for China, Mexico, and other suppliers, minimising classification errors and customs holds.

Our in-house brokers ensure compliant documentation for bonded warehouse entries, FTZ declarations, and any “mini-bid” surcharges resulting from capacity constraints.

In a world where trade policy can shift overnight, Wakool Transport equips you with the flexibility, deep China expertise, and compliance know-how to keep goods flowing—no matter how the market changes.

Comments